I can guess what you’re thinking: Here we go…someone else talking about DEI initiatives for accounting firms…again. But stay with me.

DEI (diversity, equity and inclusion) is more than just hiring a diverse group of people to check the “incorporate DEI” box. It’s about being inclusive, no matter someone’s skin color, gender or age. DEI should also focus on the qualities you can’t see (e.g., work experience, conflict management style, mental well-being, education, talents).

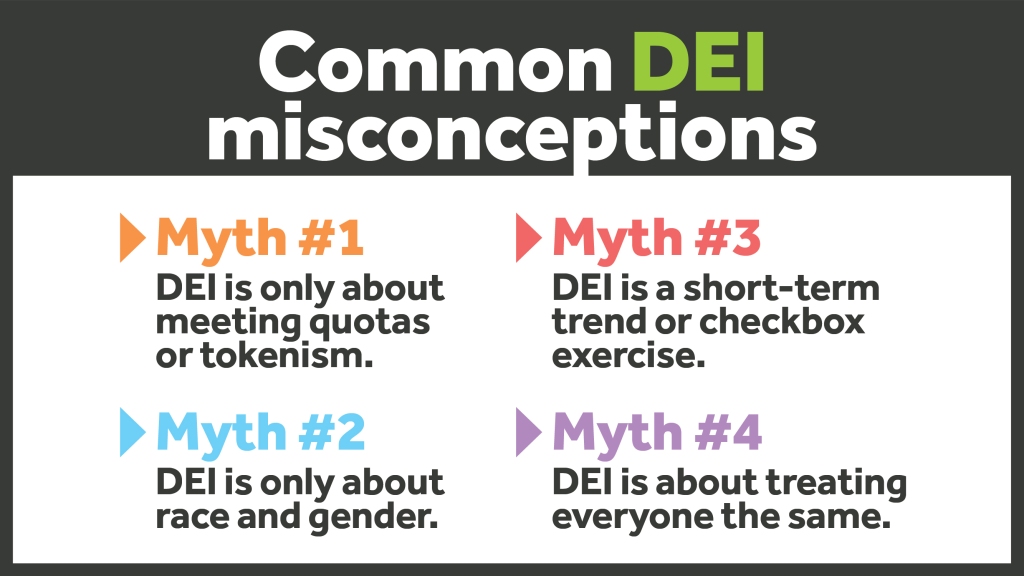

I want you to walk away from this blog with a new understanding of DEI and how one small step in the right direction can make waves. You may be surprised by what you learn! Let’s start with a few common myths you may have heard about DEI, and then we’ll tackle how you can prioritize your DEI efforts.

Common DEI misconceptions

The importance of DEI has become more of a focus over recent years. But there are still misunderstandings that can prevent the implementation of DEI initiatives for accounting firms. If you recognize any of the four common misconceptions below, it will help you create meaningful conversations within your firm and help you meet your DEI goals.

Myth: DEI is only about meeting quotas or tokenism.

Reality: DEI isn’t just about having diverse representation just for the sake of it. It’s about creating an inclusive environment where all team members have equal opportunities. DEI isn’t about numbers—it’s about an environment where everyone feels valued and respected. It also helps your firm evolve into a culture that embodies varying perspectives, which encourages more creativity and innovation.

Myth: DEI is only about race and gender.

Reality: Although race and gender are important aspects of DEI, it encompasses many dimensions of diversity: age, sexual orientation, disability, religion, nationality, socioeconomic background and more.

Myth: DEI is a short-term trend or checkbox exercise.

Reality: DEI isn’t just the latest buzzword—it’s a long-term commitment that requires sustained effort, continuous education and systemic change. Accounting firms should integrate DEI into their values, policies and culture.

Myth: DEI is about treating everyone the same.

Reality: The premise of DEI is not to treat everyone the same. It’s recognizing that individuals have different needs, experiences and backgrounds. And that means treating your staff fairly and equitably, which can mean providing tailored approaches or accommodations, so they have the resources they need to thrive.

Laying the foundation

The only way DEI initiatives for accounting firms can work is by creating a solid foundation. Ask yourself the following two questions:

- Where am I right now in my DEI journey?

- What is my “why” when it comes to DEI?

Maybe you’re just dipping your toes in the water regarding your DEI efforts, or maybe your firm has been making small steps toward inclusion in the workplace for a few years now. Either way, you have to know your “why.” If you’re embarking on this DEI journey mainly to check a box, you may want to think about it differently.

If you’re unsure of your “why,” let me share some facts that may spark some inspiration. According to research by Cloverpop:

- Inclusive teams make better business decisions up to 87% of the time.

- Teams that follow an inclusive process make decisions two times faster with half the meetings.

- Decisions made and executed by diverse teams delivered 60% better results.

Work with your team to develop your “why,” and use that to build your foundation.

Creating a strong foundation for DEI includes the following:

- Confirming leadership buy-in. DEI initiatives cannot succeed if your leadership isn’t on board. Leaders must demonstrate a genuine commitment to DEI by advocating for it, setting clear goals and expectations, leading by example and holding themselves—and others—accountable for creating an inclusive culture. If you need to get leaders on board, come to them with a business case. Identify what DEI initiatives can do for your firm, such as hiring differently, providing benefits that support new moms, and allowing for flexible PTO during summer for parents.

- Building a strategy. Your firm’s DEI strategy should align with your mission, values and business model. Your “why” should be your starting point. Outline specific goals, timelines and action plans, and define key performance indicators (KPIs) to measure progress.

- Conducting an assessment. Examine the current state of DEI within your firm by reviewing policies, practices and staff experiences to identify gaps and areas for improvement. Conduct internal surveys about inclusivity and ask your staff questions, such as how included they feel or what initiatives are missing or could be better.

- Making room in the budget. Keep in mind that you’ll need to dedicate resources to implementing and sustaining DEI initiatives. That may mean making room in your budget.

Ensure you create a strong foundation so your DEI initiatives have the best chance of succeeding. That’s why benchmarking is so important—so, let’s dive in.

The importance of benchmarking

Much like many aspects of business, benchmarking also applies to your DEI efforts. Benchmarks help your firm evaluate your efforts, identify areas for improvement and compare your performance against other firms. Below are common benchmarks that can help aid DEI initiatives for your accounting firm.

- Representation. What is the demographic composition of your firm?

- Equitable pay. Are staff compensated fairly and without bias based on gender, race or other protected characteristics?

- Staff engagement and satisfaction. How does your staff perceive the inclusivity of your firm? Do you ask for feedback regarding fairness, career development opportunities and the effectiveness of your firm’s DEI initiatives?

- Leadership representation. Do the leaders in your firm reflect diversity and inclusion?

- Vendor representation. Does your firm make an effort to engage with and support diverse-owned businesses?

- Training and education. Does your firm provide ongoing DEI training and education to your staff?

While your firm may track different DEI benchmarks, this list is a good place to start. Sit down with your team and see where you stand regarding these benchmarks. The answers to these questions will help guide your DEI journey. And they’ll allow you to create specific goals and targets, so you can continue to monitor your efforts.

Start DEI initiatives for your accounting firm

Now that we’ve covered the importance of a strong foundation and common benchmarking for DEI, let’s talk about some initiatives you can implement within your firm.

- Establish a DEI committee. Assemble a dedicated task force to oversee and drive DEI efforts within your firm. Include staff from all levels to ensure diverse perspectives and experiences.

- Develop a DEI policy. Create a comprehensive DEI policy that outlines your firm’s commitment to diversity, equity and inclusion. Be sure to include specific goals, strategies and measurable targets to keep your team on the same page. And don’t forget to continuously evaluate your policy and make changes as needed.

- Educate staff. Conduct regular educational sessions and workshops to increase awareness and understanding of DEI. This could include sessions on bias, cultural competence, inclusive leadership and respectful workplace behavior.

- Foster inclusive hiring practices. Implement strategies to attract and retain diverse talent. Modify job descriptions and use inclusive language; expand recruitment channels to reach underrepresented groups; establish partnerships with organizations that focus on diverse talent; and focus on small community colleges or universities as their range of diversity is more extensive.

- Diversify leadership or promotion opportunities. Ensure that staff have the opportunity to advance into leadership positions or within their career. Provide mentorship or sponsorship programs to help support underrepresented employees.

- Conduct regular pay equity audits. Review compensations regularly to identify and address any racial or gender pay gaps. Be sure that staff are paid based on skills, qualifications and experience.

- Implement flexible work arrangements. Each staff member may have diverse needs, so consider flexible work options, such as remote work or flexible hours.

- Partner with external organizations. Collaborate with external organizations that are focused on diversity and inclusion. This will allow you to leverage their expertise, learn best practices and participate in DEI initiatives with other businesses.

- Regularly evaluate progress. Establish metrics and KPIs to measure the effectiveness of your DEI initiatives so you can consistently assess your progress. Check in with your staff to gather their feedback and make necessary adjustments to continue improving your DEI work.

Be the drop that starts the wave

If there’s only one thing you take away from this blog, let it be that implementing DEI initiatives for your accounting firm isn’t a one-and-done. It takes continuous education and putting in the work to ensure you’re creating a firm focused on diversity, equity and inclusion.

One tiny drop in the ocean can create waves. And the same applies to DEI in your firm. Lay your foundation by determining your “why,” and make an intentional plan to incorporate DEI initiatives. Be the drop…it may just make waves in the profession.