As numbers people, you know the importance of relying on data. Not only does it provide you with the basis of your financial analysis, but it can help your firm in other ways. Data can help you discover your best (and worst) clients. It can also help you determine the accounting advisory services that will best benefit your firm, as well as uncover areas where your firm can improve.

Accounting firms can use data analytics tools like Insights to help make informed business decisions and better serve clients. These kinds of tools help firms identify and understand key patterns, trends and anomalies—based on data you already have. Access to such insights provides accounting professionals with the information they need to make intentional decisions about the clients they serve and the services they provide.

Not only that, but data gained from tools like Insights also helps your clients gain clarity into their businesses. It’s a win-win all around. So, let’s talk about using data to help elevate your accounting advisory services.

Uncover your ideal clients

Before we jump into data and how it elevates your accounting advisory services, we need to take a step back and first look at the clients you’re serving. Looking at your client list, are you able to decipher between your ideal clients and your non-ideal clients? Let’s quickly review the differences between each.

- Ideal clients are the clients you love to serve and are good at serving. They pay their bills on time, meet deadlines, listen to and implement your advice, and purchase additional services from you. They’re ideal for your business.

- Non-ideal clients are the ones who tend to be a drain on resources, don’t pay on time, refuse to use your tech stack and don’t take advantage of your additional service offerings. They’re not ideal for your business.

So, without spending a lot of time trying to figure out ideal vs. non-ideal, what can you do? Short answer: use accounting data you already have to your advantage.

By connecting to QuickBooks® Online or Xero, Insights helps you uncover important information about your clients. Information like who doesn’t pay on time, which clients may be a possible mismatch based on services, those who are considered champions (i.e., ideal), and those who need more attention or are at risk for churn.

With this information at your fingertips, you can decide who to keep on your client roster and who needs to be weeded out. The easy part is automatically getting this information…the hard part may be letting the non-ideal clients go. (Rootworks members, we can help with that. Log in to the Rootworks platform and access our client termination letters here.)

Evaluate advisory services

Now that you’ve uncovered your best (and not-so-great) clients, you can focus on accounting advisory services. Take a look at your updated client list and then consider their types of business and what services will benefit them.

For example, maybe you work with mostly dental or optometry practices. What kind of services would benefit them? Maybe they use your firm mostly for tax planning activities, like 401(k) or retirement plans. But perhaps they should also consider other services.

The goal of advisory services is to fill the gap for your clients. Make it your job to know what’s best for each client and further enhance your trusted advisor role. Get to know what services they currently use and those they need. For example, should a client have health savings accounts? Would outsourcing their payroll be beneficial? Insights can help you fill the gap and serve your clients proactively.

Bolster your bottom line with stale pricing data

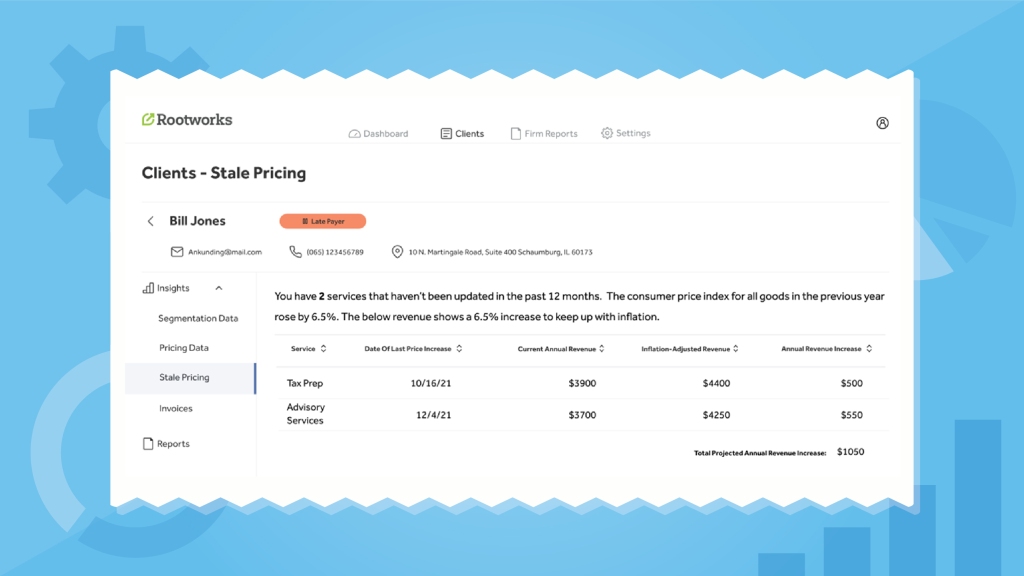

Consider what you’re currently charging for your accounting advisory services. Then think back to the last time you adjusted your pricing to meet market demand. Chances are new clients (ideal only, of course) are paying your current prices, but long-term clients haven’t seen a price increase in quite some time…or ever.

If this sounds like your firm, Insights has you covered with its stale pricing feature.

Instantly see the services your firm offers and also uncover data on the last time you increased prices and how your revenue would look if you stayed on track with inflation. With this data at your fingertips, you can easily justify price increases to your clients.

Start offering accounting advisory services

Your firm is sitting on a treasure trove of data that can exponentially improve the way you do business. By connecting to Insights (for free, by the way), you’ll gain instant access to information to help bolster firm profitability while elevating your trusted advisor status at the same time.

Get connected and up your accounting advisory services game today!