“My data is in the cloud…why do I need to back up QuickBooks® Online (QBO) files?”

This is a common question from any QBO user. And the answer is that while QBO maintains disaster recovery backups of their entire platform, they don’t cover the data (e.g., customers, transactions, deposits, invoices) in your individual account.

“So QBO doesn’t save my data?”

Technically, they do—just not in a format that’s decipherable to the end user (i.e., you). But your data is securely saved with the data of every QBO customer, so if you lose your data, finding and recovering it from a specific point in time would be nearly impossible. As stated in Intuit’s terms of service (section 6.1.1), the onus for backing up your online data is on you.

In this article, we’ll cover a few common data loss scenarios, what the Shared Responsibility Model is and why it’s important, and how to back up QBO files. So, let’s dive in.

How data loss happens

Scenario 1: The innocent-looking email link

An employee clicks a link in an email from an unknown sender. That sender is a hacker who now has possession of your QBO files and the data in them. They’re now corrupted or worse—completely gone.

Scenario 2: The accidental deletion

An errant mouse click deletes a customer, transaction, deposit or invoice from your file. There’s no “undo” button here.

Scenario 3: The disorganized upload

You ask an employee to mass upload data into QuickBooks Online because you’ve acquired or merged with another business. While uploading a large CSV file (or using third-party software), tons of data is duplicated or deleted, and unwanted mistakes overtake your once-clean QBO files.

These data loss scenarios are more common than you think

In each of these more-common-than-you-think scenarios, there’s data loss and you desperately need to restore it. But without proper online backups in place, you risk the ramifications of data loss: time, money and your clients’ trust.

QuickBooks disaster recovery backups aren’t used to restore account-level data—they protect the QuickBooks Online platform in case something happens to Intuit’s main data centers…like a natural disaster or a cyberattack. It’s up to you to back up your data. And that’s why you need to know about the Shared Responsibility Model.

The Shared Responsibility Model

It’s crucial to understand that cloud security is a shared responsibility between the provider and the customer.

While providers secure the underlying infrastructure, customers are responsible for:

- Properly configuring cloud services

- Managing user access and permissions

- Securing endpoints that connect to the cloud

- Training employees on security best practices

In fact, Gartner predicts that through 2025, 99% of cloud security failures will be the customer’s fault, not the provider’s. This highlights the importance of understanding your role in cloud security.

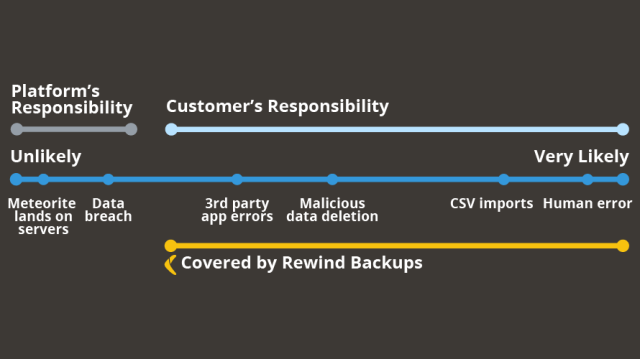

Look at the image below, more specifically, the top two lines. You’ll see that QuickBooks Online is responsible in the unlikely event that a meteorite lands on its servers or a data breach occurs based on a company-wide cyberattack.

However, notice that you are responsible for:

- Third-party app errors. This includes any applications that integrate with QBO to sync financial data. If there’s a snafu with a third-party app, it’s on you to recover that data.

- Malicious data deletion. Whether cybercriminals or employees with ill intentions maliciously delete your data via ransomware, phishing attacks or malware, if your data is wiped, QBO can’t recover it. It’s on you to recover the data. (Are you seeing the theme here?)

- CSV imports. While a typically quick and easy way to get data back is via a bulk upload, if the upload fails or the file isn’t clear of duplicates or bad data, you risk wiping out existing data. And, again, it’s your job to recover it.

- Human error. Humans aren’t perfect, and they never will be. It’s inevitable that someone will inadvertently delete important data—never to return. It’s up to you to recover or recreate that deleted data.

Unless you have a tool that handles online backup and restoration, the chances are that a data loss due to any of the above scenarios is a forever loss. So, let’s talk about how you can mitigate this risk by backing up QBO data.

Backing up QuickBooks Online

As you can see, backing up your QuickBooks Online files is critical. Luckily, there is a tool that can handle this for you: Rewind Backups for QuickBooks Online.

Rewind provides automatic backups to QuickBooks Online by picking up data security where Intuit leaves off—backing up more than 25 individual items, like transactions and lists (including attachments and reports), and even client files. It’s your “undo” button when there’s an error in data entry, a bad CSV import or data loss.

Rest easy knowing that your data is automatically backed up on a daily basis. You can also schedule additional backups at any time (highly recommended if you’ll be making significant changes to your QBO file). Restoring QuickBooks Online data can be as simple as a few clicks of a mouse.

By using a tool like Rewind, you’re ensuring there’s no downtime or unfixable data loss.

Maintain peace of mind

It’s important to remember that you bear much of the responsibility when it comes to backing up your data—as QuickBooks disaster recovery only goes so far. Prepare for any scenario by taking advantage of automatic backups through Rewind so you can maintain peace of mind that your data is securely protected.