Cash flow management is at the center of every business. Let’s face it…cash is king. And without it, you can’t build a successful business.

That’s why maintaining a healthy cash flow should always be front of mind with clients. It ensures that the business can pay common expenses such as salaries, utilities and taxes while also having funds to put toward growth and business expansion.

Because cash is at the heart of any enterprise, cash flow forecasting is an ideal advisory service to offer small business owners. Effectively forecasting future cash flow means that you can help your clients predict cash shortages or surpluses. This information can then be used to make smart, informed business decisions—such as hiring new employees, investing in significant purchases or cutting back on expenses in certain areas.

If you’re interested in offering cash flow forecasting services in your firm, read on for our top four tips on launching this much-needed product.

Tip 1: Understand the immense service benefits and articulate them clearly to clients

If you’re going to sell cash flow forecasting services to clients, you have to be able to articulate the benefits with great clarity. And there are a lot of benefits!

Be sure that your clients understand every value proposition:

- Provides foresight into organizational earnings—When you add up what’s expected from all revenue streams and compare to total liabilities (working capital), it provides highly useful data about future earnings and potential cash flow problems. This helps immensely with long-term and short-term strategic financial planning.

- Supports better planning for significant purchases—Another advantage of the cash flow forecast is that it can help an organization predict whether a large expenditure can occur without creating the risk of negative cash flow. When you know how much cash on hand you have at any time, it’s much easier to plan large purchases.

- Helps keep spending in check—Reviewing the cash flow forecast arms business owners with the data required to help meet revenue and net income goals. If a business is at risk of not meeting revenue targets, adjustments in spending can be made earlier on.

- Offers credit and term benefits—Managing cash flow properly bolsters a company’s financial health. And when a business shows an ample cash balance, it can lead to added benefits such as a larger line of credit, better loan payment terms, overall positive cash flow and better financial management.

- Offers investors an overview of financial health—Some investors will use cash flow forecasts as a tool to determine the financial health of an organization. With more clarity about the future, investors can take early action to generate desired results.

Tip 2: Set up a modern technology ecosystem

The success or failure of a new product or service offering relies in large part on internal processes. Firms must be able to deliver services with speed and accuracy…and that demands an operation that runs at peak efficiency.

As most know, when it comes to efficiency, all roads lead back to technology—advanced cloud-based technologies that is. Modern firm leaders are taking advantage of integrated, browser-based applications and automation via APIs (application program interfaces) to customize their tech stacks with the apps of their choosing.

Because today’s applications are built to support seamless data transfer via easy integration, firms really can pick and choose the apps required to build a custom tech stack. The days of relying on integrated suites are all but over.

When systems talk to one another and data flows seamlessly among them, what you get is a single source of truth. That is, real-time, accurate data on which to build powerful, detailed cash flow forecasts.

Consider two of the profession’s leading (and integrated) cloud solutions to make easier work of delivering cash forecasting services.

- Client accounting: As the market leader, QuickBooks® Online (QBO) is an obvious choice to serve as your firm’s client accounting software hub. With multiple APIs and integrations, it’s easy to build a tech stack that is highly efficient and supports end-to-end workflow automation.

- Cash flow forecasting: CashFlowTool is a leading cash flow management platform that integrates with QBO for on-demand, daily insights into aggregate data. The application also enables easy sharing of key metrics across departments and roles so all stakeholders can stay informed on cash flow—supporting proactive decision making.

Accurate, timely cash flow forecasting requires that you have access to real-time data from all areas of the business. Having the right technology in place helps you achieve this with relative ease.

Tip 3: Harness the power of AI

Artificial Intelligence (AI) is not the future. It’s here. And machine learning continues to gain momentum in the accounting profession with the goal of reducing mundane tasks. This frees accounting professionals to spend more time on higher-value, higher-impact tasks.

When you combine AI with other technologies, it’s a true game-changer. Some key benefits include:

- Enhanced output quality: AI helps to minimize human errors by automating manual tasks. It can often support real-time status of financial matters by processing documents via NLP (natural language learning), which makes daily reporting possible and inexpensive.

- Immense time savings: As mentioned above, AI removes manual processes from the equation. This equates to big time savings—time that can be redirected to high-value advisory work.

- Heightened compliance awareness: AI-enabled systems can monitor documents against ever-changing rules and mandates to flag potential compliance issues early.

The big takeaway here is that AI has the power to help firms improve the quality of services (output) and support better-informed, proactive decisions.

Tip 4: Put a pricing model in place

Deciding how you price this service should be a core component of initial planning. As a high-value, recurring advisory offering, setting a fee that represents the true value for clients is recommended.

It’s important to note that value pricing takes time and practice. Some firms may choose to start with a fixed fee and advance to value pricing after the service is up and running for an ample amount of time.

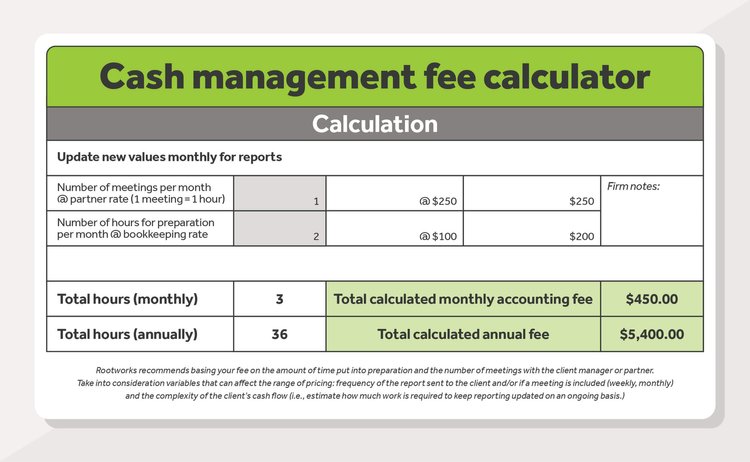

Once ready to venture into value pricing, using a fee calculator is highly recommended. This allows you to think through all aspects of service delivery, including prep time, meetings with client managers and partners, and the complexity of cash flow reporting.

Below is a good example of a cash management/forecasting fee calculator:

Keep the cash flowing in

There are numerous opportunities for firm owners to open up new revenue streams. Today more than ever, small business clients need dedicated advisory support to ensure long-term growth and sustainability. And who better to offer that support than their trusted accounting partner?

Applying a few (or all) of the tips in this article can help you cash in on the cash flow forecasting services opportunity. A new revenue stream awaits!