Presenter: Roman Kepczyk, Director of Firm Technology Strategy, Rightworks

Table of Contents

- Tax Season 2025 Survey Participants

- Firms Report Increased Clients and Better Tax Season vs 2024

- Digital Transformation Accelerates

- Talent Challenges Persist

- The Path Forward

Key Findings at a Glance

- 62.4% of firms had more tax clients in 2025 vs 2024.

- 60.7% said the 2025 tax season was better than 2024.

- Nearly 50% promoted digital client tool usage.

- One-third of firms increased staff hours in 2025.

- 47.4% will focus more on training to retain staff.

Who Participated in the Tax Season 2025 Survey?

Including yourself, how many employees work at your firm?

| Total | |

|---|---|

| Total Answering | 173 |

| 1 (Sole Proprietorship) | 2.3% |

| 2-4 | 2.9% |

| 5-7 | 1.2% |

| 8-10 | 5.8% |

| 11-15 | 19.1% |

| 16-20 | 13.9% |

| 21-25 | 8.7% |

| 26-30 | 6.9% |

| 31+ | 39.3% |

Which of the following describes your job role?

| Total | |

|---|---|

| Total Answering | 173 |

| Sole Proprietor/Practitioner | 2.3% |

| Owner | 8.7% |

| Managing Partner/CEO/CFO/President/Principal | 24.9% |

| Vice President/Partner/Senior Manager/Director/Manager/Controller | 28.3% |

| IT | 2.3% |

| Staff Accountant | 2.3% |

| Consultant | 1.2% |

| Firm Administrator/Office Manager | 23.7% |

| Bookkeeper | 2.9% |

| Other | 3.5% |

Firms Report Increased Clients and Better Tax Season vs. 2024

Compared to the 2024 tax season, the majority of firms (62.4%) reported having more tax clients in 2025, while 30.1% had the same number. Only 7.5% saw a decrease.

“Tax season went much better this year…our processes were more streamlined, the team was better prepared, and client submissions were timelier, reducing last-minute pressure and improving overall efficiency.” Tax Season 2025 Survey respondent

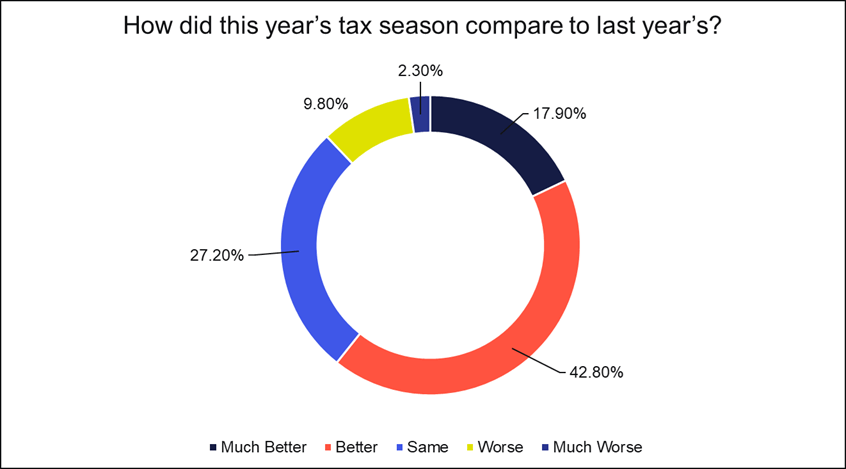

Overall, 60.7% of firms indicated the 2025 tax season went better than in 2024. Large firms were more likely to have a positive experience compared to smaller firms. Another 27.2% said it was about the same as 2024, while only 12.1% felt 2025 was worse.

Watch Now: What the Survey Results Mean for Your Firm

Digital Transformation Accelerates

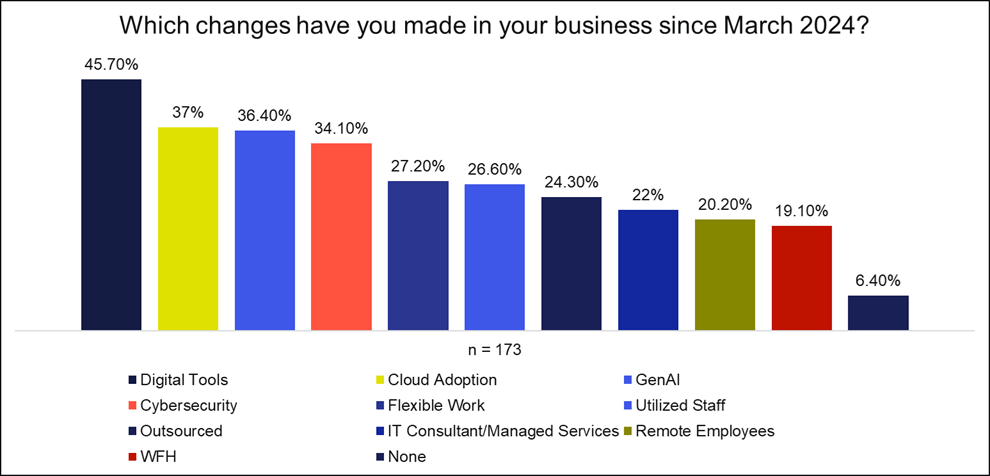

The top change firms made since 2024 was promoting the use of digital tools with clients, implemented by nearly half (45.7%) of respondents across all firm sizes. Cloud-based solutions and hosted applications (used by 37%), have enabled firms to securely access client data anytime, anywhere.

However, smaller firms lag significantly in cloud adoption compared to larger practices. To stay competitive, small firms will need to embrace digital transformation and meet evolving client expectations for tech-enabled services.

Talent Challenges Persist

Despite client growth, firms continue to face staffing issues. In 2025, 32.4% of firms required staff to work more hours to manage the workload. Larger firms were more likely to increase hours and hire additional interns compared to 2024.

How did you handle staffing this tax season?

| Total | |

|---|---|

| Total Answering | 173 |

| Hired more interns and/or part-time staff | 37.6% |

| Adjusted our work style to provide more freedom (remote work) | 37% |

| Utilized outsourced services for tax bookmarking and preparation | 34.7% |

| Staff had to work more hours | 32.4% |

| No change | 22.5% |

| Scaled back our tax return client base to accommodate our staff | 12.1% |

| Other | 1.7% |

To ease the burden going forward and boost retention, 47.4% of firms plan to provide more training and perks. However, 15% of firms don’t expect to make any changes to their talent strategies.

Based on the 2025 tax season, which statement below best describes how you would like to move your firm forward for the future?

39.3% of respondents feel tax season is becoming too stressful overall. Firms of all sizes will need to prioritize staff development, embrace automation, and build a strong learning culture to develop skilled professionals and improve the employee experience.

“Tax season is too stressful. We wish our clients would embrace more technology.” Tax Season 2025 Survey respondent

Watch the Webinar: Strategies for Overcoming Talent Challenges

The Path Forward

Firms that had a better 2025 tax season attributed their success to improved staffing, streamlined processes, and getting client data on time. Combined with targeted technology investments, focusing on these key areas can help firms build long-term resilience.

For expert advice on navigating year-round firm challenges, watch Roman Kepczyk as he unpacks the Tax Season 2025 Survey data. Expect:

- Talent development and retention techniques

- Automation and AI workflows best practices

- Top digital client collaboration options in use today

Ready to commit to your people, process, and technology? Watch Tax Season Takeaways.