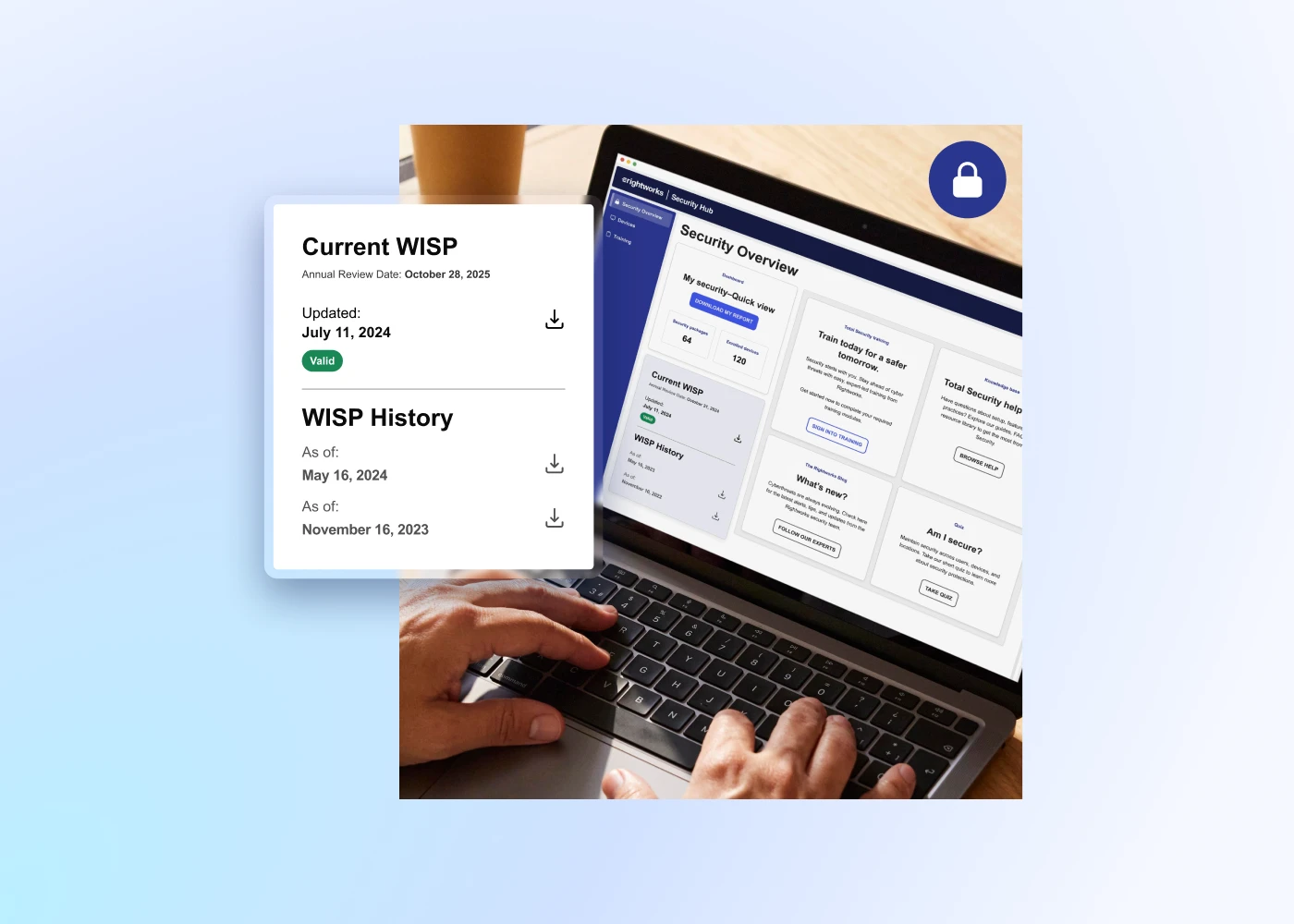

Need a WISP? We’ll handle everything.

Let Rightworks create a Written Information Security Plan (WISP) that keeps you compliant with IRS and FTC requirements—and gives you a blueprint for a threat-proof firm.

3 reasons to let Rightworks create your WISP

It’s required for PTIN renewal

The IRS and FTC won’t let you renew your Preparer Tax ID Number (PTIN) without it.

We’ll save you time & stress

Don’t waste billable hours. Let our experts create a comprehensive WISP for you.

We’ll identify security gaps

We’ll assess your vulnerabilities and recommend solutions to prevent data breaches.

A custom WISP means faster compliance, fewer worries

Rightworks makes it fast and easy to satisfy IRS Security Summit guidelines and the FTC Safeguards Rule. Click “Buy Now” to order your custom WISP and we’ll walk you through the next steps. Current Rightworks customers, click “Book a Call.”

Want to DIY?

Get started with a free WISP template

Use our free template to learn more about data security requirements, or to complete your WISP on your own.

Compliance meets confidence

Protect your PTIN and your reputation

See why a custom WISP is your key to PTIN renewal—and a smart way to show your clients that you’re serious about data security.

Recommended Resources

Overwhelmed by WISP requirements? Download our infographic to discover essential steps and see how partnering with an expert simplifies the process.

Accounting firms are required to have a WISP. In this webinar, learn why it’s essential to your firm’s security and compliance to partner with an expert to get it right.

What exactly is a WISP, why do you need one, and what should it include? All that and more, here.