Selecting the right accounting and tax software is crucial for accounting professionals and firms. This guide breaks down the best solutions available in 2025, highlighting their key features, ideal use cases, and what to do before and after making your selection.

Table of Contents

- General Accounting Solutions for Small to Medium Firms

- Top Tax Preparation Software

- Recommendations by Firm Focus

- Tips for Making a Selection

- You’ve Chosen Your Software…Now What?

General Accounting Solutions for Small to Medium Firms

Click on a solution for more details.

| Application | Key Features | Best For |

| QuickBooks Desktop Enterprise |

|

Growing businesses with complex inventory and multi-location operations |

| QuickBooks Online |

|

Most small to medium businesses, service providers, and firms that want room to grow |

| Xero |

|

Service-based businesses, firms working closely with clients, and those needing efficient, collaborative accounting solutions |

| Sage 50 Accounting |

|

Midsize businesses, retailers, wholesalers, and firms requiring customization and integration with other business systems |

| FreshBooks |

|

Freelancers, consultants, and small service businesses focused on creative or service-oriented clients |

| Zoho Books |

|

Small businesses seeking a cost-effective, integrated solution |

1. QuickBooks Desktop Enterprise

QuickBooks Desktop Enterprise is your all-in-one business command center that grows with you.

What are the top three features of QuickBooks Desktop Enterprise?

- Handles everything from accounting to inventory, reporting, job costing, and payroll—with capacity for 1 million items.

- Keeps your data secure with custom user permissions—control exactly who sees what and when.

- Streamlines order management through one central dashboard that sends instructions directly to your team’s mobile devices.

2. QuickBooks Online

Designed for small to medium businesses, service providers, and growing firms that need scalability and comprehensive financial management capabilities, QuickBooks Online‘s abundance of new features has made it one of (if not the) leading accounting platform in the last few years.

QuickBooks Online Plus

QuickBooks Online Plus delivers comprehensive financial management with robust accounting features, multi-user access, and specialized tools for inventory tracking, project profitability, and multiple currencies.

It combines everyday essentials like invoicing and expense tracking with advanced capabilities like financial planning and live tax assistance, all accessible from anywhere through the mobile app.

QuickBooks Online Plus and Payroll Core Bundle

The QuickBooks Online Plus and Payroll Core Bundle builds on the comprehensive accounting foundation with complete payroll functionality, automating taxes, forms, and direct deposits while offering employee benefits administration.

The key differentiator is the integrated full-service payroll system that handles everything—from automated tax calculations to workers’ comp administration, health benefits, and retirement plans—all within the same platform.

Online Plus and Payroll Premium Bundle

The Online Plus and Payroll Premium Bundle enhances the Core offering with premium-level payroll features, including:

- Same-day direct deposit

- Dedicated HR support

- Mobile time tracking

The key differentiators are the elevated service elements—24/7 expert product support, HR support center access, expert payroll review services, and the ability for employees to track time on mobile devices—making it ideal for businesses needing more comprehensive human resource management tools.

What are the top three features across all QuickBooks Online versions?

- Real-time income and expense tracking with seamless bank and credit card integration.

- Comprehensive invoicing, bill tracking, and payroll integration options.

- Extensive ecosystem with 650+ app integrations and customizable reporting dashboards.

3. Xero Accounting Software

Xero’s cloud-based accounting solutions are a great fit for service-based businesses and firms that prioritize client collaboration. Their modern financial management approach has strong automation capabilities and allows for customization to suit your needs.

What are the top three features of Xero accounting software?

- Automated bank reconciliations and intelligent invoice reminders.

- Real-time collaboration tools for accountants and clients.

- Integration ecosystem with over 1,000 business applications.

4. Sage 50 Accounting

Sage 50 Accounting works well for midsize businesses, retailers, and wholesalers requiring depth in inventory management. Like Xero, it too has customization options. Unlike Xero, it’s desktop-based (installed) software.

What are the top three features of Sage 50 Accounting?

- Comprehensive invoicing, expense tracking, and bank reconciliation

- Real-time inventory management with advanced expense control

- Desktop reliability and Office 365 integration

5. FreshBooks

FreshBooks is a streamlined accounting platform built specifically for freelancers, consultants, and small service businesses with creative or service-oriented clients who need intuitive financial tools.

What are the top three features of FreshBooks?

- Exceptionally streamlined invoicing and expense tracking interface

- Integrated project management and time tracking capabilities

- User-friendly design focused on service business workflows

6. Zoho Books

Zoho Books is a cost-effective accounting solution for small businesses seeking integrated financial management within a broader business software ecosystem.

What are the top three features of Zoho Books?

- Automated workflows for invoicing and expense management

- Multi-currency and multi-user support for growing businesses

- Seamless integration with Zoho’s complete business application suite

Tax Preparation Software

Click on a solution for more details.

| Application | Key Features | Best For |

| Intuit ProConnect™ Tax |

|

Firms needing cloud access, handling complex returns, and looking to provide advisory services |

| Intuit Lacerte® Tax |

|

Firms handling complex corporate and individual returns |

| Intuit ProSeries® Tax |

|

Practices with technical tax provision needs and GAAP compliance requirements |

| Bloomberg Tax |

|

Firms with technical tax provision needs and GAAP compliance requirements |

| Drake Tax |

|

Firms with high client volume needing streamlined tax processing |

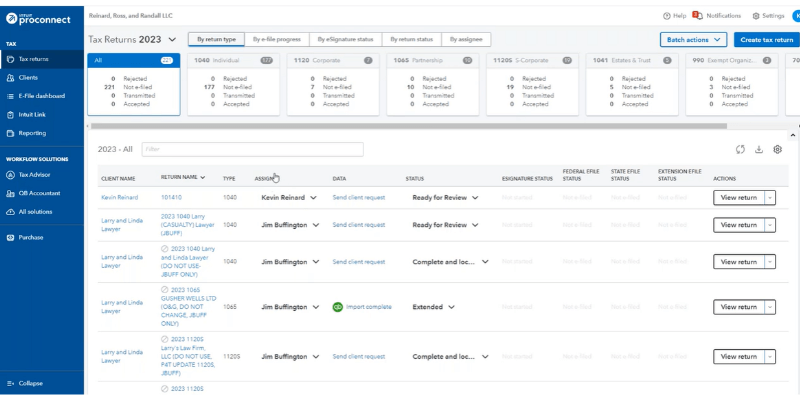

7. Intuit ProConnect Tax

Intuit ProConnect Tax is a cloud-based tax preparation solution for firms handling complex returns. Customers may need a QuickBooks integration or want to expand their advisory services capabilities.

What are the top three features of ProConnect?

- Seamless cloud-based workflow with direct QuickBooks integration

- Advanced tax planning and advisory insights tools

- Support for over 7,200 tax forms with award-winning functionality

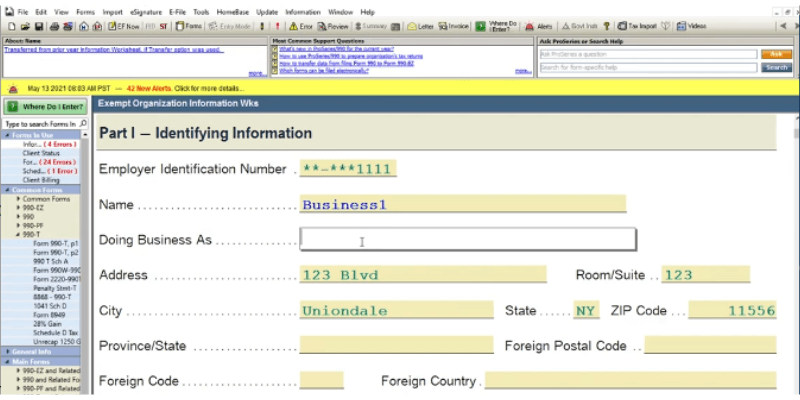

8. Intuit Lacerte Tax

Intuit Lacerte Tax is a professional-grade desktop tax solution for firms managing complex corporate and individual returns that require comprehensive diagnostic capabilities and extensive form coverage.

What are the top three features of Lacerte?

- Powerful desktop solution with hosting options for flexible access

- Advanced diagnostics for identifying errors and optimization opportunities

- Extensive form coverage for complex business and individual returns

9. Intuit ProSeries Tax

Intuit ProSeries Tax is a comprehensive tax preparation software designed to maximize efficiency, reduce preparation time, and streamline your entire tax workflow from start to finish.

With over ten package choices on the menu–ProSeries definitely has the widest range of capabilities dependent on the exact tax work you do.

What are the top 3 features across all ProSeries versions?

- Cloud access with automatic backups—90% of users report significant time savings

- Fixed asset manager that simplifies depreciation calculations and ensures precise asset tracking

- Built-in eSignature tool—eliminating paper handling and accelerating approvals

10. Bloomberg Tax Provision

Bloomberg Tax Provision is a specialized tax solution focused on firms with technical ASC 740 income tax provision needs and strict GAAP compliance requirements. Its audit-ready tax provisioning allows you to send reports directly to auditors, all from an easy-to-use, sleek interface.

What are the top three features of Bloomberg Tax?

- Comprehensive ASC 740 income tax provision capabilities

- Robust GAAP compliance tools and documentation

- Detailed state-by-state tax calculations and analysis

11. Drake Tax

Drake Tax is an efficient tax preparation system optimized for high-volume tax practices that need streamlined workflows and consistent processing capabilities.

What are the top three features of Drake Tax?

- Exceptionally efficient interface designed for high-volume processing

- Comprehensive tax preparation capabilities with minimal learning curve

- Cost-effective solution for firms processing large numbers of returns

The Best Accounting & Tax Software Recommendations by Firm Focus

Selecting the right software depends heavily on your firm’s size, client base, and specialization. Here are our recommendations based on different firm profiles:

| Firm Type | Primary Recommendation(s) | Secondary/Alternative(s) | Why This Fits |

| Solo practitioners/Freelancers |

|

|

Simple, affordable, easy to use |

| Small General Practice |

|

|

Scalable, integrates with many apps |

| Mid-sized/Inventory/Retail Firm |

|

|

Advanced inventory, customization |

| High-Volume Tax Practices |

|

|

Fast, efficient for large return volumes |

| Complex Tax/Compliance |

|

|

Advanced diagnostics, ASC 740, compliance |

| International/Global Firms |

|

|

Multi-currency, global features |

8 Tips for Choosing the Best Accounting & Tax Software for You

The best accounting or tax software for you depends on your business’s size, industry, growth plans, and specific workflow needs.

Here are eight tips to help guide your selection process:

1. Identify Your Needs and Pain Points

- Tip → Identify needs and pain points

- Why it matters → Ensures software solves your real problems

Assess your current workflows and pinpoint where you spend the most time or encounter the most errors. Then, list your must-have features (e.g., multi-currency, payroll, inventory management) and “nice-to-haves” (e.g., AI-powered forecasting, advanced analytics).

2. Prioritize Scalability and Flexibility

- Tip → Scalability and flexibility

- Why it matters → Accommodates future growth

Choose software that can grow with your business, supporting more clients, users, and complex requirements as you expand. Don’t forget to look for flexible pricing plans and the ability to add features or integrations as your needs evolve.

3. Opt for Cloud-Based Solutions

- Tip → Cloud-based access

- Why it matters → Enables remote work and real-time collaboration

Cloud-based platforms offer anytime, anywhere access, real-time collaboration, and automatic updates—features now considered essential for most businesses in 2025.

Cloud solutions also facilitate remote work and easier integration with other business tools.

4. Focus on Security and Compliance

- Tip → Security and compliance

- Why it matters → Protects data and meets legal requirements

Ensure the software uses robust security measures like encryption, multifactor authentication, and regular backups. Then, check for compliance with industry standards and regulations (e.g., GDPR, local tax laws).

5. Evaluate User Experience and Support

- Tip → User experience and support

- Why it matters → Reduces errors and training time

Select a platform with an intuitive, user-friendly interface to minimize training time and errors. Review the quality and availability of customer support, including tutorials, live chat, and knowledge bases.

Pro tip: Read testimonials and reviews from businesses similar to yours to gauge customer satisfaction, reliability, and real-world performance.

6. Check Integration and Automation Capabilities

- Tip → Integration and automation

- Why it matters → Streamlines workflows and saves time

Look for seamless integration with your existing tools (e.g., payroll, CRM, inventory) to reduce manual data entry and streamline workflows. Additionally, automation features—recurring invoicing, bank reconciliation, and AI-driven insights—can save significant time and reduce errors.

7. Take Advantage of Free Trials and Demos

- Tip → Free trials/demos

- Why it matters → Allows you to test before you buy

Test shortlisted software with free trials or live demos to assess usability, feature fit, and compatibility with your workflows before committing.

8. Consider Industry-Specific Needs

- Tip → Industry-specific features

- Why it matters → Addresses unique business needs

Lastly, if your business has unique requirements (e.g., project tracking for construction, inventory for retail), ensure the software offers relevant features or add-ons.

You’ve Chosen Your Accounting and Tax Software…Now What?

Selecting the right accounting and tax software is just the first step in optimizing your firm’s operations.

Once you’ve made your choice—whether it’s QuickBooks, Xero, Sage, or another solution—the next critical decision is how to implement and manage it effectively within your overall technology ecosystem.

My advice? Consider a centralized workspace for all your applications.

A centralized platform (like Rightworks Cloud Premier):

- Allows you to sign in once to access all your applications

- Enables teams to work from anywhere there’s an internet connection

- Gives clients real-time access to the latest data and information

- Keep your data safe with reliable backups

- Strengthens security with multifactor authentication, managed credentialing, and advanced threat protection

Your software choice is just the beginning—how you implement and connect it determines your true competitive advantage. By centralizing your technology ecosystem, you’ll transform good accounting tools into a powerful platform that drives efficiency, security, and growth for years to come.