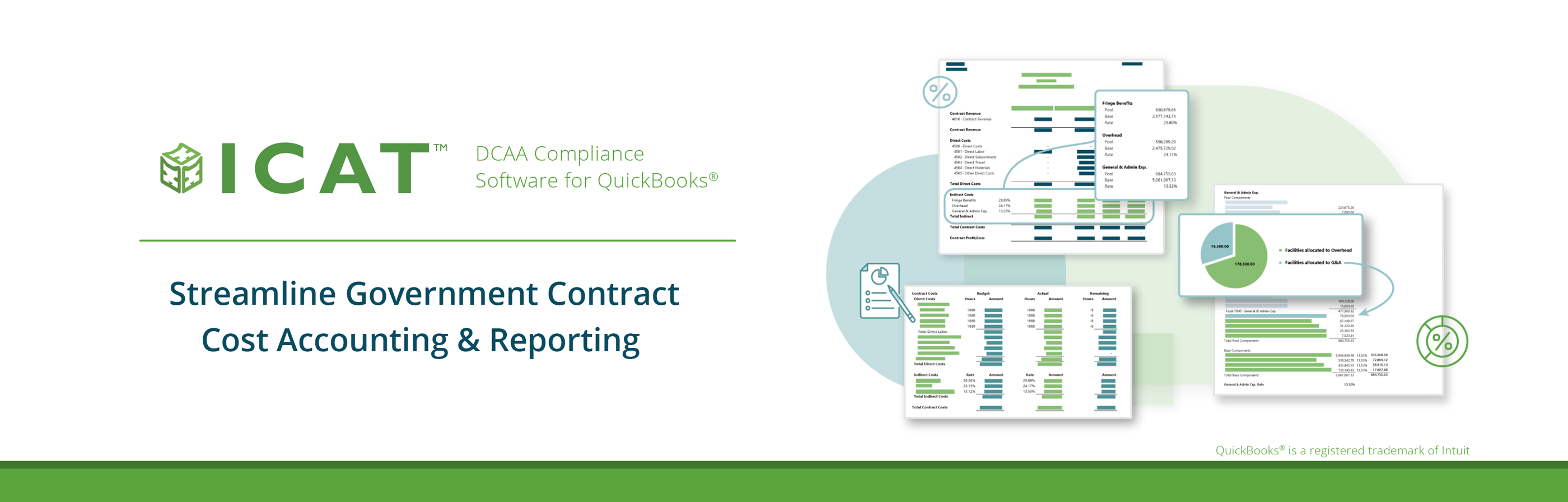

ICAT provides an affordable, easy-to-use solution for DCAA-compliant cost accounting and reporting for federal government contractors using QuickBooks.

Whether you’re pursuing cost-type contracts, managing indirect rates, or preparing incurred cost submissions, ICAT integrates with QuickBooks to automate government contract cost accounting — keeping you compliant while saving hours every month.

Essential functionality purpose-built for government contractors.

Focus on winning and managing contracts, not wrestling with spreadsheets.

ICAT turns QuickBooks into an enterprise-grade government contracting solution with instant visibility into fringe, overhead, and G&A rates, contract status reporting, incurred cost proposals, and budget analysis. It’s the powerful engine behind growing contractors who need DCAA compliance without the complexity or cost of enterprise software.

- Automatically allocate indirect costs across contracts

- Always know your indirect rates and wrap rates

- Generate fully-loaded contract cost reports from your general ledger to view total job costs

- Gain instant insights on contract funding utilization to manage performance and avoid over-billing

- Develop provisional billing rates to recover indirect costs in the new year

- Analyze budget scenarios to inform pricing and strategic planning

- Save hours of effort preparing your Incurred Cost Proposal with cost data automatically populated into schedules required to support FAR 52.216-7

ICAT Advantages

Start running reports in hours — not weeks or months.

- Accommodates any indirect cost pool structure – customize your rate model, or use an ICAT template

- Works with any timekeeping and payroll solutions

- Add features as your business needs and contract requirements grow

We also offer expertise. With CPE-eligible training on government contract accounting fundamentals and FAR compliance, we help you get it right from day one.

For over 20 years government contractors have trusted ICAT to pass SF1408 accounting system reviews and satisfy FAR and DFARS compliance requirements.

Start your free 30-day trial today and see how ICAT works with your own QuickBooks data.

*ICAT currently supports QuickBooks Desktop editions. A new ICAT experience for QuickBooks Online is coming soon. Join our mailing list for product updates.